By Andy Scott • Managing Director

Well, not all, just the forward-thinking ones providing valuable advisory services to clients.

Ok, if you are sitting comfortably on your history of Sage book; with Xero and QuickBooks, the shining stars of booking-keeping lighting up your office; we will begin.

I am not an Accountant, but I felt less distance from the profession when I learned that there are three types of Accountants - those that can count and those that can’t.

A couple of years ago, I wrote about the impact of the coronavirus pandemic on the profession and stated that I have no idea how to convey all the material effects of Covid-19 in the financial reporting and statement disclosures, pointed out in a Deloitte publication, but there was a paragraph that resonated with my thinking:

“Ahead of any changes, accountants should consider switching to Cloud-based software that can sync with their desktop, and meet with clients over the phone or Internet, instead of in-person.” AccountancyAge

Apart from the pandemic driving companies to online software and their accountants, there are two other key drivers: Making Tax Digital (MTD – not to be confused with a bad April Fool’s Joke); and Brexit paperwork such as Commercial Invoicing, which whilst unpopular in some quarters, was democratically voted for by the UK.

So, we have more internet communications, more paperwork and tax compliance all pointing to the joined-up world of accountancy and software…

The producers of bookkeeping software have done a cracking job of using Accountancy firms as a channel to market and serve the needs of small businesses.

With the big boys of SAP and Oracle being the best-known names at the high end of the corporate spectrum, how are the trusted advisors of your profession addressing the needs in that massive area between sole trader bookkeeping and BIG Corp?

In working with The Big Four, I understand they have sprouted system integration wings that wear different hats to avoid the audit v advisory police. But how are the small and medium-sized firms addressing the systems advisory void in moving from double-sided accounting entries to Enterprise Resource Planning (ERP)?

I get plenty of calls from business transformation and systems advisory companies looking for solutions to meet their client automation needs – but none from Accountants.

Yes, the spreadsheet wizards can help clients to address specific processes; or advice on best-of-breed solutions that do certain things well e.g., SalesForce CRM, HubSpot marketing automation, Shopify e-commerce, etc. But is this the best advice for companies that are planning to grow?

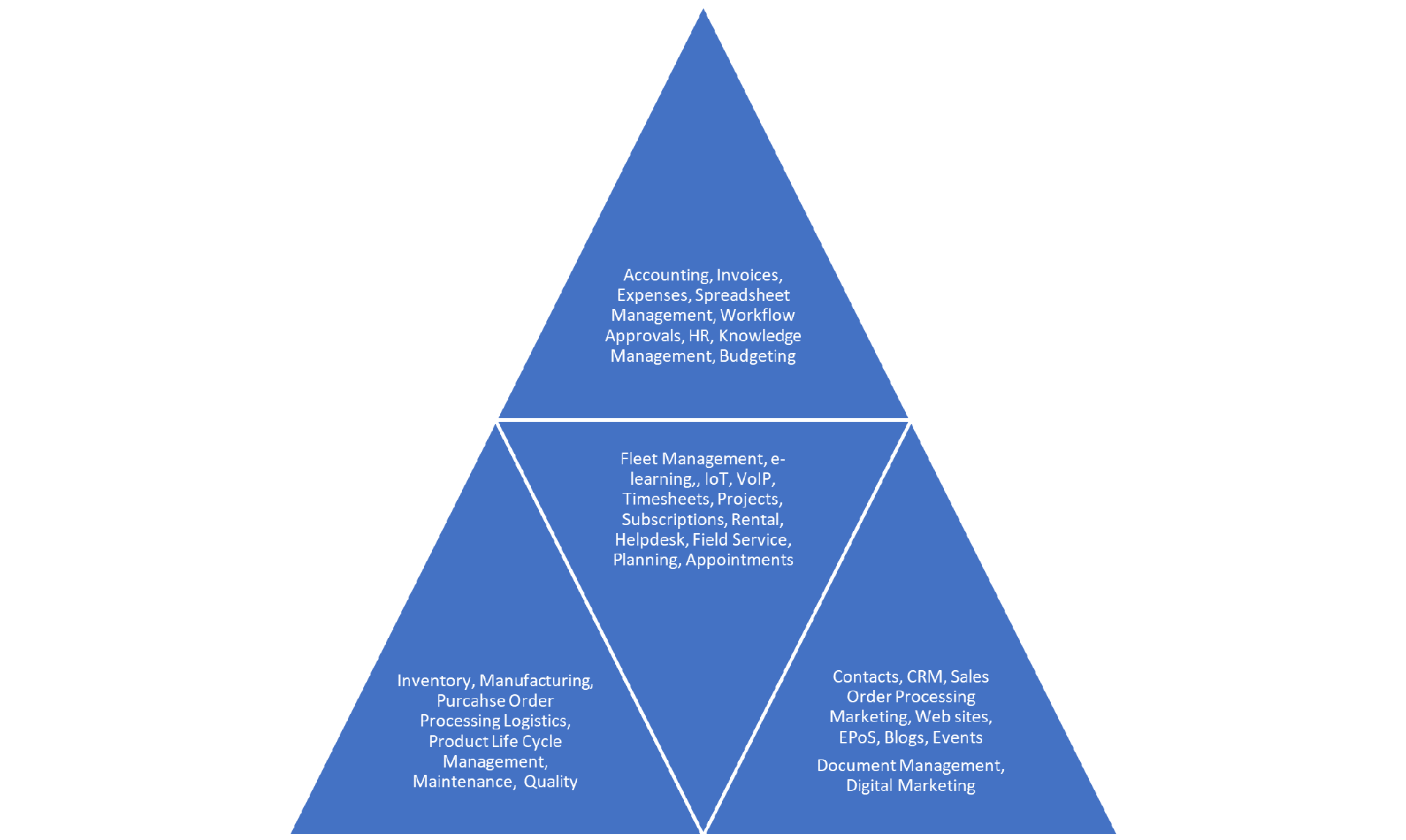

In Business Studies at Uni back in the 1980’s, I learnt about the building blocks of a business, being people, products/services, processes, customers, suppliers, finance (I will have forgotten a few, but it was ages ago!). Why not apply the same foundation blocks to automation?

Maybe start with Finance, then go for order processing; then inventory management, works orders, projects, HR, marketing, and so on. The whole company won’t collapse if you take away one of the foundation blocks. Well not if you don’t take away the foundation blocks, just keep on building at your own pace – adding the automation tools when the time is right for you.

Credit to the marketeers of Oracle NetSuite and Microsoft Dynamics – all accountants have heard of these solutions, and they will relay stories of the heavy price and commitment necessary to implement them. What if there was an affordable solution that started at Free, and then under £30 per user per month to add whatever you want?

You can find out more about how a finance professional advises her clients on building their automated business model by getting in touch with our team today...